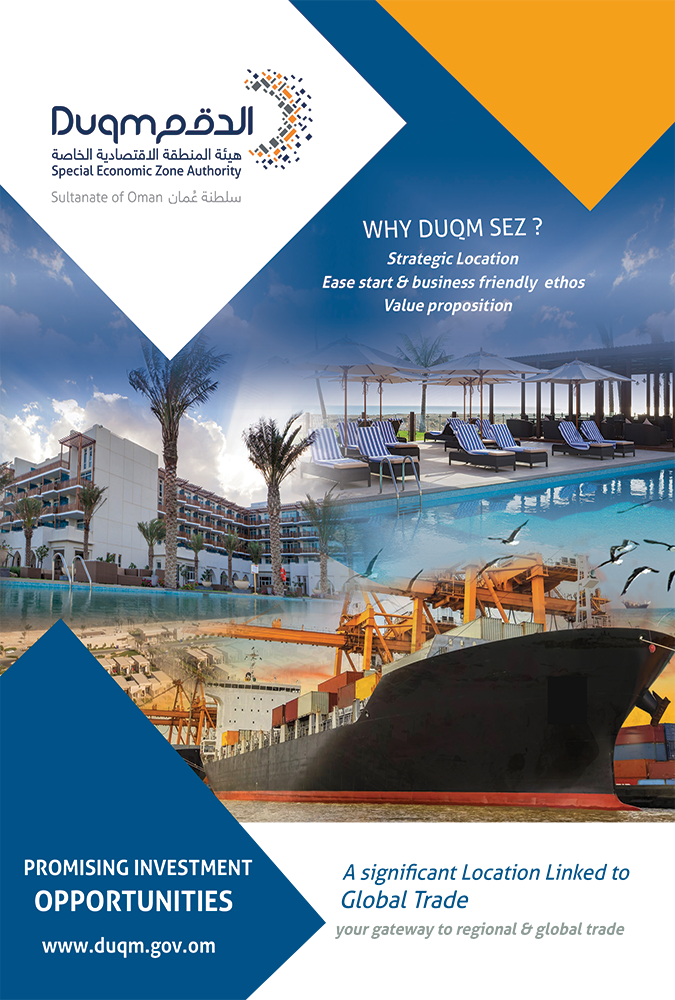

DUQM SPECIAL ECONOMIC ZONE

Your Gateway to Regional and Global Trade

The Duqm Special Economic Zone has unsurpassed advantages in positioning your business within strategic reach of some of the fastest-growing markets in the Middle East, South Asia, East Africa and beyond.

Strategic Location

Prime geographical position on the Arabian Sea, at the crossroads between Asia and Africa.

• Situated far outside the Hormuz Strait, the SEZ lies within proximity of international shipping lanes serving East-West, Upper Arabian Gulf, and East-Africa trade. Excellent connections by air, land and sea access regional and global markets.

Easy Start and Business-Friendly Ethos

A wide range of support services tailored to the investor’s

requirements — a one-stop shop for setting up your business.

• Business-friendly and investment-ready, Duqm SEZ is primed to cater to the needs of investors. Regulatory policies have been structured to offer a differentiated approach designed to attract, retain and grow firms.

• Our One-Stop Shop, offers an efficient way to register your business and investment interest. Once logged in, your application is speedily processed against a checklist of criteria, while a dedicated team engages with you directly to assess your specific requirements — leased land, labour, utilities, and so on.

Value Proposition

Duqm SEZ offers an integrated package of incentives and benefits

designed to provide investors with a competitive advantage:

• Up to 100% foreign ownership.

• No currency restrictions.

• Tax exemption for 30 years, renewable for a further 30 years (does not apply to banks, financial institutions, insurance and reinsurance companies, telecommunication providers and land-transport companies — unless registered with SEZAD and licensed to operate within SEZ limits).

• Exemption from minimum capital requirements, as stipulated in the Commercial Companies Law and other statutes.

• Free repatriation of profits and capital.

• Usufruct agreements up to 50 years, renewable for similar periods.

• Freedom to import all goods (with the exception of legally banned merchandise) without prior approval or permit unless classified as explosives or chemical products.

• No restrictions related to the retention period in the Zone, unless otherwise specified by SEZAD Board of Directors. Investors may also transport goods within or into any other free zone in the Sultanate.

• Products finished or assembled in the area treated as locally produced.

• Right to open representative offices inside the customs jurisdiction, subject to their registration in accordance with the regulations in force in the Sultanate.

Sub-Zones of Excellence

Geographical clustering — long a recipe for success in free zones around the world — is at the heart of SEZAD’s strategy for attracting investment across an array of industrial and economic activities. Clustering boosts prosperity by bringing a critical mass of investors, service providers, customers, suppliers and training institutions into close proximity.

The master-plan envisions as many as 8 distinct sub- zones:

• Industrial Zone

• Sea port & Dry-dock

• Tourism Zone

• Central Business District

• Fisheries Zone

• Logistical Headquarters

• Residential Zone

• Education & Training Zone

The Duqm SEZ master plan is inspired and shaped by natural land forms, with terraced development embedded into the slopes and streets of the site topography.

Stretching over 2000 sq. km with 90 km of coastal line, Duqm SEZ is the Middle East’s most promising expanse of industrial and economic real estate. An undertaking of this magnitude requires judicious planning that takes into account Duqm’s comparative advantages, as well as the nation’s developmental goals. Working alongside the finest urban planners, SEZAD has approved a master-plan that demarcates exclusive zones for specific types of investment and development — a framework to guide the development of the SEZ over the long term.